tel: 888.868.8467

In real estate investing, speed is often the difference between closing a profitable opportunity and missing out entirely. But there’s one common issue that can delay funding and derail a project before it even starts: permits.

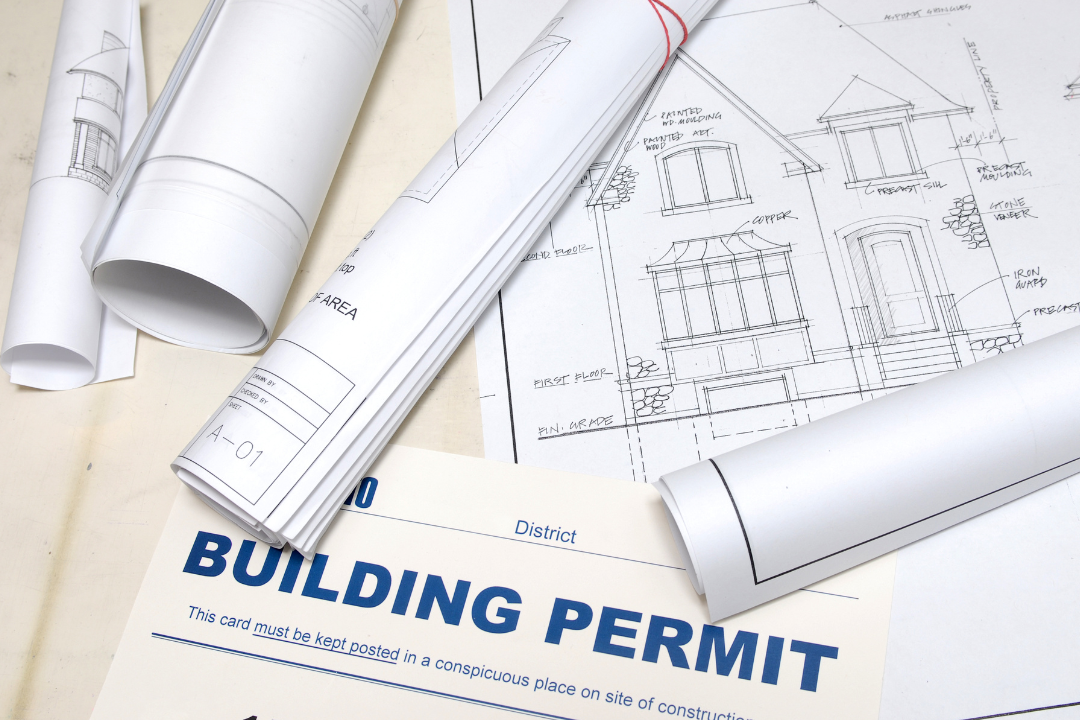

Whether you’re tackling a ground-up construction project, a major renovation, or even a simple conversion, having the correct permits—or at least a well-defined plan to obtain them—can significantly affect your ability to secure financing, especially from private lenders.

Here’s what borrowers need to understand about permitting and why it matters to your loan timeline.

Private lenders aren’t just funding properties—they’re funding execution plans. Permits represent forward progress and a level of preparedness that gives lenders confidence the project can be completed on time and within budget.

Without permits in hand, or a clear plan for when and how they’ll be secured, your project presents more risk. This can lead to:

Best-case scenario. If your permits are already approved and ready to go, your project is seen as “shovel-ready.” This can dramatically shorten the underwriting process and allow for quicker funding—sometimes in as little as 7 to 10 business days.

Many lenders will still consider the loan if permits are in process, but they’ll want to review:

Clear documentation and realistic timelines are critical here. Be honest about where things stand and be prepared to show a track record of moving the process forward.

This is where things get tricky. If you’re still working with architects, haven’t submitted for permits, or don’t have clarity on zoning or code compliance, the lender may put the loan on hold until that’s resolved.

At the very least, expect additional questions, a longer approval timeline, and possible adjustments to loan terms based on perceived risk.

In private lending, clarity and momentum matter. The permit process is one of the first ways a lender gauges your preparedness and commitment to the project.

By understanding how permitting affects the loan timeline—and proactively addressing it—you’ll be in a much stronger position to get your deal funded quickly and smoothly.

If you’re planning a project that involves permits, start planning for them now. It could make all the difference in securing the financing you need, exactly when you need it.

Disclosure: TaliMar Financial, Inc. dba TaliMar Financial, CA DRE License 01889802 / NMLS 337721. For information purposes only and is not a commitment to lend. Programs, rates, terms and conditions are subject to change at any time. Availability dependent upon approved credit and documentation, acceptable appraisal, and market conditions.